Evotec SE Case

Financing state of the art R&D and biologics manufacturing

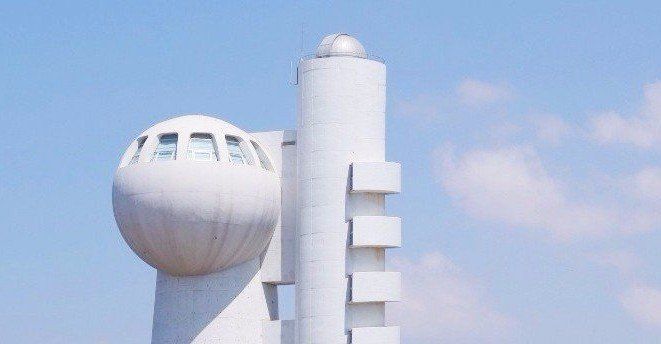

The transaction was signed by Evotec CEO Dr Werner Lanthaler, Evotec CFO Enno Spillner, Alessandro Izzo, EIB Director Equity, Growth Capital and Project Finance, and EIB Vice-President Ambroise Fayolle at a ceremony held on Evotec’s Campus Curie in Toulouse on February 10, 2023.

Enno Spillner, Chief Financial Officer of Evotec, commented: “We are excited to enter into this second financing agreement with the European Investment Bank. By funding transformational projects in key areas of public interest, EIB is an important driver of innovation in the EU. We are honoured and excited to be able to create new R&D partnering opportunities and establish Europe’s first J.POD® biologics manufacturing plant through the innovative financing model from the EIB at highly attractive terms. This new agreement with EIB builds on the excellent relationship we have developed as part of the first financing agreement entered in 2017. The EIB’s support will help us deliver on our mission ‘Together for Medicines that Matter’.”

EIB Vice President Ambroise Fayolle said: “We are very pleased to support Evotec's investments in research, development and innovation with this second financing agreement signed with the European Investment Bank. It demonstrates our commitment to supporting European biotech companies at the cutting edge of innovation in a sector marked by very strong global competition. This EIB investment will also have a significant impact on activity in the Toulouse region, as it will help to finance a 12,000 square metre plant that will create more than 200 highly skilled jobs.”

The transaction is going to be signed by Members of Evotec’s Management Board and the Vice President of the European Investment Bank, Ambroise Fayolle, during a ceremony on Evotec’s Campus Curie in Toulouse today. This financing agreement, as well as a previous loan of € 75 m by the EIB in 2017, has been developed in cooperation with kENUP Foundation, an NGO supporting innovation in Europe.

The European Investment Bank's Press Release on the matter can be found here.

Cape Biologix Case

plant-based manufacturing of affordable proteins for use in diagnostics, diagnostics and therapeutics

Belinda Shaw, CEO of Cape Biologix Technologies Ltd; Hon. Prof. Mamokgethi Phakeng, Vice-Chancellor of the University of Cape Town; Dr. Wolfram Otto, Investor

API for Africa Case

Strengthening regional demand and supply chains while reducing Africa's dependency on drug imports

Serum Institute

of India - TB Vaccine Case

of India -

EIB impact financing to develop novel vaccine against tuberculosis

Malaria Fund Case

Fighting Malaria with an innovative financing mechanism

Bio-Convergence Case

Connecting the innovation systems of the European Union and the State of Israel

Pluristem Case

Funding regenerative cell therapy platform, initial application in COVID-19

Evotec Case

Financing a strategic drug-development pipeline

BiondVax Case

Developing a Universal Flu Vaccine

Valneva Case

Valneva Case

Innovation in vaccine developement

Innovation in vaccine developement